Meta Description:

Learn the top 10 investment strategies for 2025. From AI-powered portfolio management to green finance and digital assets, this guide covers everything you need to build wealth in the new economy.

Introduction: The New Era of Investing

The world of investing is changing at an unprecedented pace. With global economic shifts, rising interest in digital assets, and the growing power of artificial intelligence, 2025 is shaping up to be a defining year for investors.

Whether you’re a beginner looking to build your first portfolio or a seasoned professional seeking advanced strategies, this guide will help you understand the 10 best investment strategies for 2025 — and how to apply them.

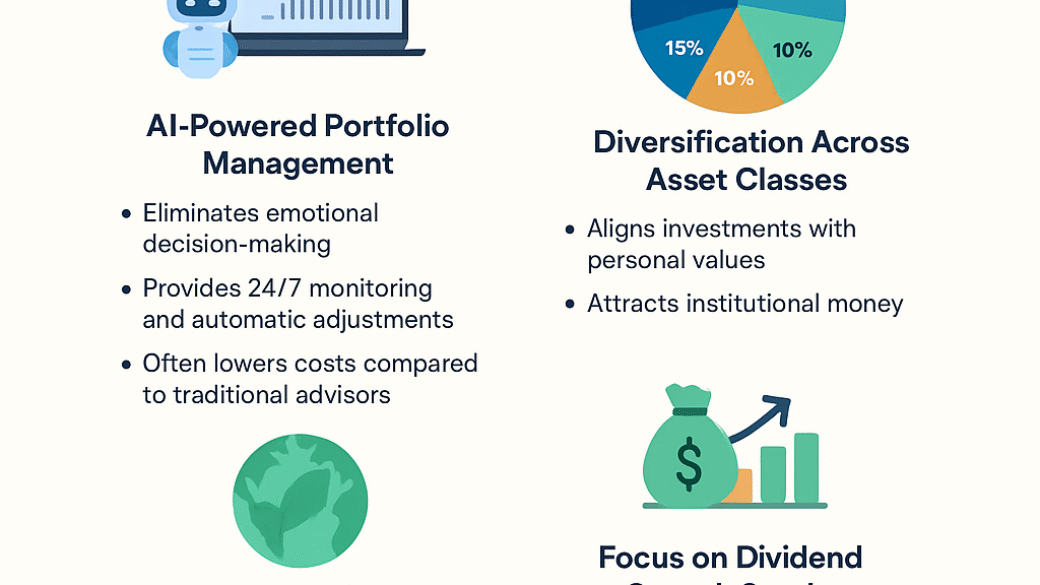

1. AI-Powered Portfolio Management

Artificial Intelligence (AI) is no longer a futuristic concept — it’s managing portfolios right now. Robo-advisors and AI trading systems can analyze market conditions, rebalance portfolios, and optimize risk/reward in real time.

Why it Matters in 2025:

- Eliminates emotional decision-making

- Provides 24/7 monitoring and automatic adjustments

- Often lowers costs compared to traditional advisors

How to Start:

Platforms like Wealthfront, Betterment, and even custom-built AI bots can automate your investment strategy.

2. Diversification Across Asset Classes

The golden rule of investing still holds true: don’t put all your eggs in one basket.

But diversification in 2025 goes beyond just stocks and bonds — it includes crypto, commodities, REITs, and even tokenized assets.

Example Portfolio for 2025:

- 40% stocks (global & sector-specific ETFs)

- 20% bonds (short-term, inflation-protected)

- 15% real estate or REITs

- 10% crypto & digital assets

- 10% commodities (gold, energy)

- 5% cash reserve

3. Sustainable & ESG Investing

Environmental, Social, and Governance (ESG) criteria are now a major driver of portfolio decisions. Green finance is booming, and companies with strong sustainability practices are outperforming those that don’t adapt.

Benefits:

- Aligns investments with personal values

- Attracts institutional money (strong demand for ESG stocks)

- Future-proofs portfolio against climate regulation risks

4. Focus on Dividend Growth Stocks

In an era of market volatility, dividend growth stocks provide a steady source of passive income. Companies that consistently raise dividends tend to have strong financial health.

Examples:

- Utilities

- Consumer staples

- Large-cap tech firms with strong free cash flow

5. Dollar-Cost Averaging (DCA)

Instead of trying to time the market, investors in 2025 are increasingly relying on DCA — investing a fixed amount at regular intervals.

Advantages:

- Reduces impact of short-term volatility

- Encourages consistent investing

- Builds wealth steadily over time

6. Alternative Investments & Private Markets

High-net-worth and institutional investors are allocating more to alternatives such as:

- Venture capital

- Private equity

- Hedge funds

- Tokenized fractional ownership (real estate, art)

For retail investors, platforms like AngelList, YieldStreet, and tokenized crowdfunding make these markets more accessible.

7. Crypto & Blockchain Assets (But Smarter)

The crypto space is maturing in 2025. We’re seeing less speculation and more utility-focused tokens — including DeFi platforms, Layer 2 solutions, and tokenized securities.

Best Practices:

- Limit crypto exposure to a small % of portfolio

- Focus on projects with real-world utility

- Use secure, self-custody wallets

8. Hedging Against Inflation

Global inflationary pressures are still present. Investors are protecting purchasing power by holding:

- Treasury Inflation-Protected Securities (TIPS)

- Commodities like gold and silver

- Real estate with rental income

9. Smart Tax Planning & Optimization

In 2025, tax-efficient investing is crucial. Strategies include:

- Tax-loss harvesting

- Holding long-term for lower capital gains tax

- Using retirement accounts (IRA, 401k) for tax-deferred growth

10. Building an Emergency Fund First

Finally, no investment strategy is complete without an emergency fund. At least 3-6 months’ expenses in a liquid, safe account ensures you never have to liquidate investments during a downturn.

Conclusion: Investing in 2025 and Beyond

The best investors aren’t those who predict the future — they’re those who prepare for it. By adopting these strategies, you’ll build a portfolio that is diversified, future-proof, and capable of thriving in a rapidly changing economy.

Whether you’re a beginner or a pro, the key is consistency, risk management, and a willingness to adapt.

Looking to automate your investment plan?

Platforms like LotusPay, Friendite Global, and TopNotchGold offer beginner-friendly and pro-level investment options tailored to your risk tolerance.

Add a Comment